change in net working capital dcf

The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094. A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets.

Change In Net Working Capital Nwc Formula And Calculator

The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital.

. One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future. Calculate the change in working capital. Change in Net Working Capital 12000 7000.

Add or subtract the amount. The net debt specifically cash position may be affected by the operational working capital requirements of the business. Deduct the debt of last year to find the net asset value.

Stable WC Change WCEBITDA EBITDA t terminal growth1terminal growth. Is typically the most complicated step in deriving the FCF Formula especially if the company has a complex balance sheet Balance Sheet The balance. So 1421666B 928M 13288B.

Add back the depreciation and amortization charges. Net working capital is the aggregate of current asset and current liability and is a measure of the short term liquidity of a business. In a discounted cash flow valuation.

This is probably the least desirable option because changes in non-cash working capital from year to year are extremely volatile and last years change may in fact be an outlier. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. The change in future revenue would require a change in net working capital.

Note that we have also calculated the change in net working capital since this figure will be used later in cash flow calculations. Change in Net Working Capital 5000. Here are some examples of how cash and working capital can be impacted.

Once we have forecasted these working capital items we link our balance sheet directly to these cells. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. The goal is to.

Merely because a company produces a net profit of 100000 does not mean the company has 100000 in cash available to. Discounted cash flow. So when the current asset which includes cash and cash equivalent increases it is tied to the short term liquidity of the business which is what I mean by tied up in operations.

This article was. The earnings or cash flow figures may be influenced by changes in working capital delta across periods. Understanding the impact of changes in net working capital is extremely important in financial modeling and corporate valuation Valuation Methods When valuing a company as a going concern there are three main valuation methods used.

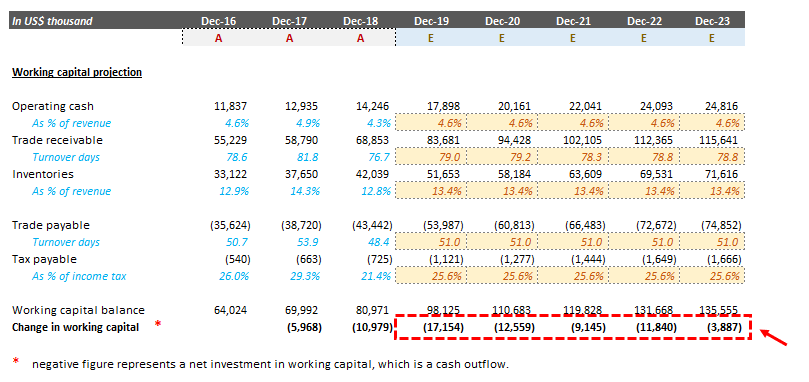

Changes in working capital are reflected in a firms cash flow statement. Working capital affects these valuation methodologies in the following ways. In this article we will learn working capital projections using assumptions.

However if the change in NWC is negative the business model of the company might require spending cash before it can sell. Converting Accounting Earnings into Cashflows. Here is an example of the calculations.

Determine whether the cash flow will increase or decrease based on the needs of the business. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities. Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild swings.

In our last tutorial we have understood detailed calculations of FCFF. Thats why the formula is written as - change in working capital. At the core working capital changes are analyzed and projected to ensure changes in cash are correctly forecast.

Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. You arent projecting flat revenue going forward.

In the DCF method change in working capital would exclude change in cash cash equivalents and current financial debt and include non financial items such as change in inventories receivables payables. DCF analysis comparable companies and precedent transactions. If a transaction increases current assets and.

The DCF calculation would give you Enterprise Value to which you would then in order to get Equity value. In this video I cover the different ratios tha. Change in Net Working Capital is calculated using the formula given below.

Thanks for your answer. You are saying because I have positive growth in the future I need to subtract change in NWC - with growth usually comes an increase in change in NWC - right. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future.

Part II of this blog identifies methods often used by business appraisers when forecasting working capital. But I just cannot wrap my head around it. Calculating the changes in non-cash net working capital Net Working Capital Net Working Capital NWC is the difference between a companys current assets net of cash and current liabilities net of debt on its balance sheet.

If the change in NWC is positive the company collects and holds onto cash earlier. Change in Working Capital Summary. Although they are considered expenses from an accounting perspective thus deducted in the.

Since the change in working capital is positive you add it back to Free Cash Flow. The implications of this assumption in a long-term forecast must be carefully analyzed.

Change In Net Working Capital Nwc Formula And Calculator

Advanced Financial Model With Dcf Valuation Efinancialmodels In 2021 Business Valuation Key Performance Indicators Company Financials

Calculate The Change In Working Capital And Free Cash Flow

Net Working Capital Formula Calculator Excel Template

Types Of Financial Statements Bookkeeping Business Learn Accounting Accounting Basics

Types Of Financial Statements There Are 3 Basic Types Of Financial Statements We Are Categorizing Ano Bookkeeping Business Learn Accounting Accounting Basics

Change In Net Working Capital Nwc Formula And Calculator

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Net Working Capital Template Download Free Excel Template

Change In Working Capital Video Tutorial W Excel Download

Changes In Net Working Capital All You Need To Know

Stock Valuation Flow Chart The Free Investors Flow Chart My World Of Work Chart

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Change In Net Working Capital Nwc Formula And Calculator

Calculate The Change In Working Capital And Free Cash Flow

Capital Structure Theory Modigliani And Miller Mm Approach Accounting And Finance Social Media Optimization Financial Strategies